by ashwani | Aug 24, 2023 | Investment, Mutual Funds

When it comes to investing, there are two main types of mutual funds: active and passive. Active funds are managed by professional investors who try to pick individual stocks or bonds that will outperform the market. Passive funds, on the other hand, track a specific...

by ashwani | Aug 17, 2023 | Investment, Mutual Funds

A value mutual fund is an investment fund that invests in stocks that are considered to be undervalued. The fund manager looks for stocks that are trading below their intrinsic value, which is the stock’s true worth based on factors such as its financial...

by ashwani | Aug 16, 2023 | Investment, Mutual Funds

Blue-chip mutual funds are a type of equity mutual fund that invests in the stocks of large, well-established companies. These companies are typically market leaders in their industries and have a long history of profitability. Blue-chip mutual funds are considered to...

by ashwani | Aug 14, 2023 | Investment, Mutual Funds

If you’re looking for a low-risk investment option, conservative mutual funds may be a good choice for you. These funds invest in a mix of debt and equity securities, which helps to reduce their risk. As a result, they tend to offer lower returns than equity...

by ashwani | Aug 11, 2023 | Investment, Mutual Funds

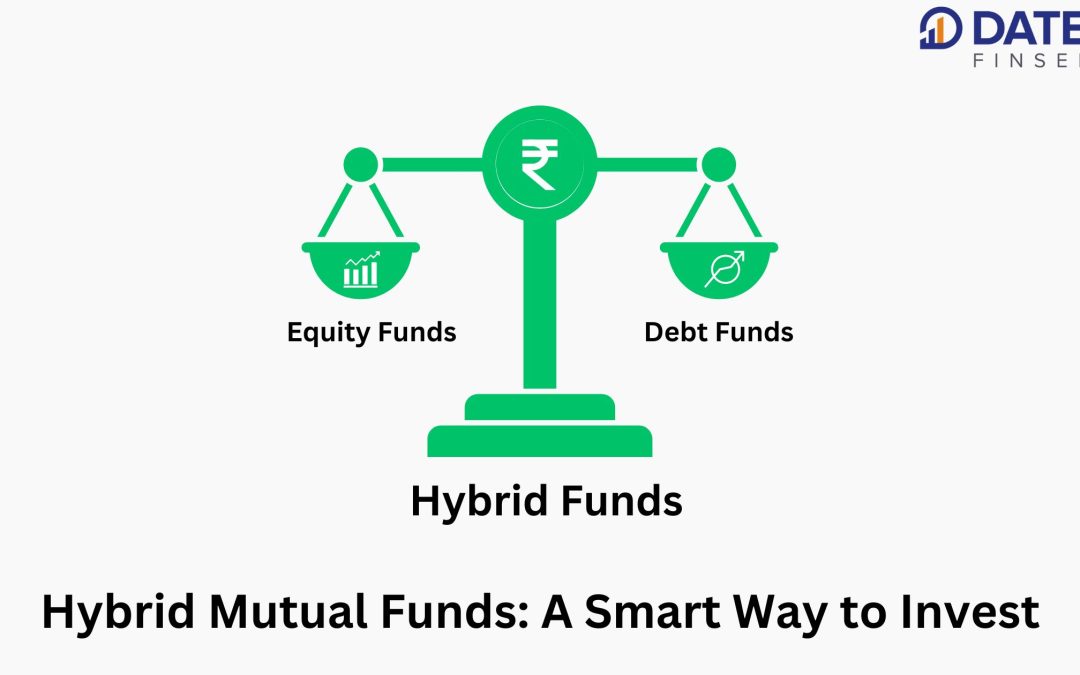

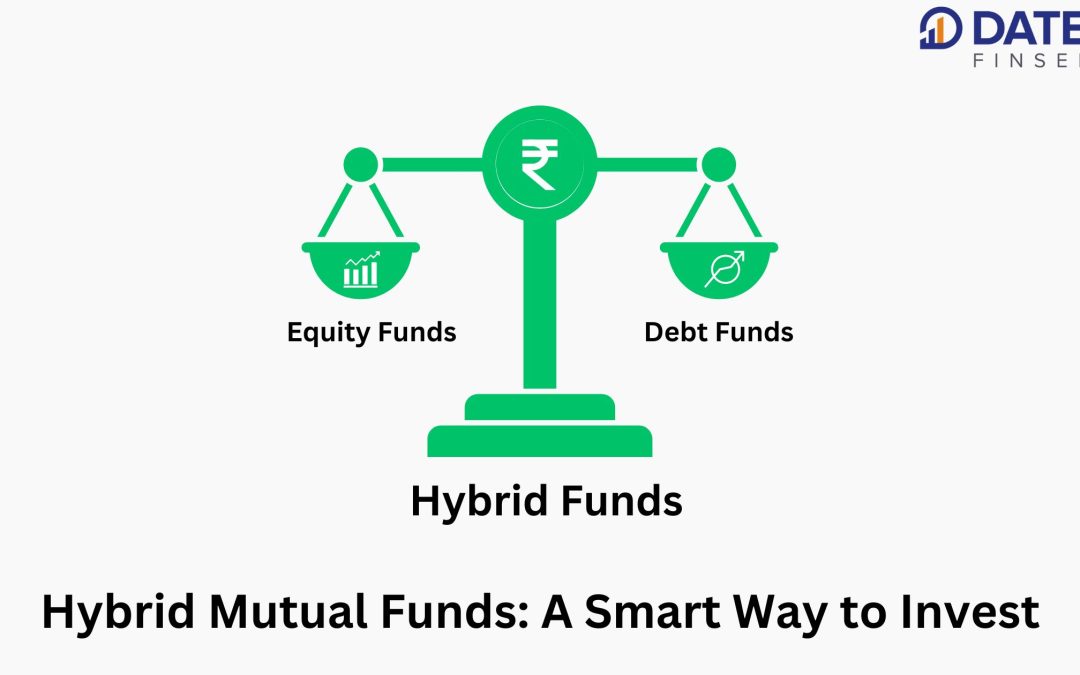

Hybrid mutual funds are a type of mutual fund that invests in a mix of equity and debt securities. This makes them a good option for investors who want to invest in both the growth potential of the stock market and the stability of the debt market. Hybrid funds...