Financial Resources and News

Blue-chip Mutual Funds

Blue-chip mutual funds are a type of equity mutual fund that invests in the stocks of large, well-established companies. These companies are typically market leaders in their industries and have a long history of profitability. Blue-chip mutual funds are considered to...

Conservative Mutual Funds

If you're looking for a low-risk investment option, conservative mutual funds may be a good choice for you. These funds invest in a mix of debt and equity securities, which helps to reduce their risk. As a result, they tend to offer lower returns than equity funds,...

Aggressive Growth Mutual Funds:High-Risk,High-Reward Investing

Introduction Aggressive growth mutual funds are designed for investors seeking high capital appreciation by investing in companies with rapid growth potential. These funds often carry a higher risk profile, but for those with a long-term investment horizon and a...

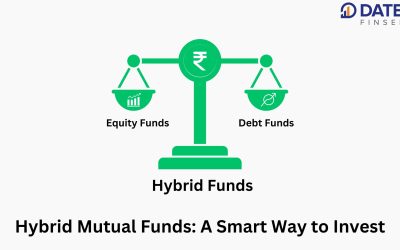

Hybrid Mutual Funds: A Smart Way to Invest

Hybrid mutual funds are a type of mutual fund that invests in a mix of equity and debt securities. This makes them a good option for investors who want to invest in both the growth potential of the stock market and the stability of the debt market. Hybrid funds...

Growth Mutual Funds

Growth mutual funds are a type of equity mutual fund that invests in companies with the potential for high growth. They are typically more volatile than other types of mutual funds, such as value funds or income funds, but they also have the potential to generate...

Mid-Cap Mutual Funds: A Guide for Investors

Mid-cap mutual funds are a type of equity mutual fund that invests in mid-sized companies. Mid-cap companies are those that have a market capitalization of between Rs. 500 crore to Rs. 10,000 crore. They are generally considered to be more risky than large-cap...

Large-Cap Mutual Funds

Large-cap mutual funds are a type of equity mutual fund that invests in the stocks of large companies. These companies are typically well-established and have a long track record of profitability. As a result, large-cap mutual funds are considered to be a relatively...

Small Cap Mutual Funds: What You Need to Know

Small cap mutual funds are a type of equity mutual fund that invests in companies with a smaller market capitalization. These companies are typically newer and smaller than large cap or mid cap companies, and they may not be as well-known. However, they also have the...